Unlocking Green Potential

Financing the Green Economy: Catalyzing Sustainable Growth

The green economy represents a transformative approach to economic development, prioritizing sustainability, environmental health, and social well-being. Financing the green economy is essential to catalyzing this shift, involving innovative financial mechanisms and substantial investment in sustainable projects and technologies.

Key Aspects:

Innovative Financial Instruments:

Green bonds, climate finance, and impact investing are pivotal in mobilizing capital towards sustainable initiatives. These instruments provide funding for renewable energy projects, energy efficiency upgrades, and conservation efforts, making it easier for businesses and governments to invest in green infrastructure.

Public-Private Partnerships:

Collaborations between the public and private sectors are crucial in scaling up investments in the green economy. Such partnerships leverage the strengths of both sectors, combining public policy support with private sector efficiency and innovation.

Regulatory Support and Policy Frameworks:

Governments play a vital role in creating conducive environments for green finance through supportive policies and regulations. These frameworks incentivize sustainable practices and ensure that financial markets are aligned with environmental goals.

Economic, Social, and Environmental Benefits:

Investing in the green economy not only addresses climate change but also drives economic growth, creates jobs, and improves public health. Sustainable investments contribute to a resilient and inclusive economy that benefits society as a whole.

Financing the green economy is a critical pathway to achieving sustainable growth and combating climate change. By harnessing innovative financial mechanisms, fostering public-private partnerships, and supporting robust policy frameworks, we can unlock the potential of green investments to create a thriving, sustainable future for all.

Keynote Speakers:

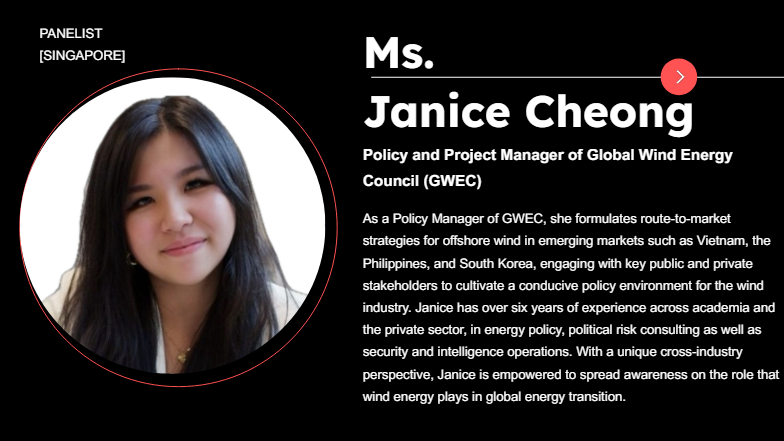

PANELISTS:

26 June 2024